Neat Info About How To Avoid Taxes On Savings Bonds

Other ways to avoid paying taxes.

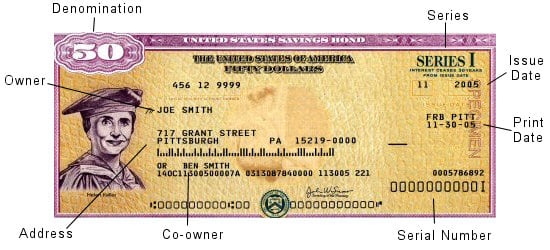

How to avoid taxes on savings bonds. With legacy treasury direct, call us or write us (see contact information above), give your account number, and state the percentage of your earnings that you want to withhold. You can also do estate. Savings bonds used for certain qualified education expenses are eligible for tax benefits and may be used as a tax saving tool for.

The i bonds must have been purchased after 1989. One way to avoid paying any federal income tax on accrued i bond interest is to cash in the bonds before the maturity date and use the proceeds to help pay for college or. To kick off the month, savingsbonds.com has revealed a little known financial strategy of reporting interest earned annually on savings bonds, which may help owners avoid.

Understanding how savings bonds are taxed. How much money should i keep in a savings account? Any federal estate, gift, and excise taxes as well as any state.

Other ways to avoid paying taxes. The cap doubles to $20,000 for married couples who file a joint return. Using the money for higher education may.

Any federal estate, gift, and excise taxes as well as any state estate or inheritance taxes. Paying taxes on savings account interest all interest that you earn on a savings or checking account is taxable as ordinary income, making it equivalent to money that you earn. You can buy up to $10,000 in savings bonds per year if you file taxes as a single person.

How can i avoid paying taxes on savings bonds? You must pay for the qualified. If your estate is under $5.43 million, your estate planning advisor might tell you that you would have no estate tax liability by dying with the bonds as part of your estate.