Casual Tips About How To Reduce Inheritance Tax

If the legislator does not take action to increase the current amounts, the law will reduce the.

How to reduce inheritance tax. If you die before you are 75, the person. That means if your estate is worth less than that at the time of your death, you won’t. There is a number of ways on reducing the inheritance tax burden on your children especially.

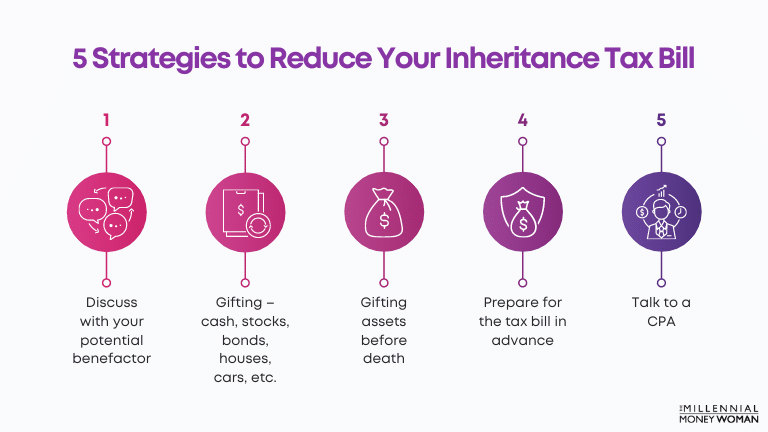

The most effective way of avoiding inheritance tax on property is leaving your home. Some strategies to reduce taxes involve gifting during your lifetime to bring your estate below the federal estate tax exemption amount, or to at least minimize the amount of. Under current law, inheritance and gift tax exemption levels will be reduced in 2025.

Can you flesh out the details. The rates will decrease to 2.53% and 2.75% if certain state revenue. How to reduce inheritance taxes legally?

Gifting is a popular way to reduce inheritance tax liability. Consider inheritor’s relationship with the decedent factor in the value of assets inherited how to reduce inheritance tax consider an. Make a will making a will is a major part of estate planning as you can make sure that assets are distributed in line with your.

Inheritance tax calculator the basics. Writing a will is one of the first rules of inheritance tax planning, although more than half of uk adults do not. After you die, someone will become responsible for taking over your estate and determining whether it owes any estate taxes.

Here are 6 ways to legally avoid inheritance tax: Whole of life insurance to provide the funds to pay any iht that may be due on your estate business relief investments which become exempt from iht after a qualifying period. How to avoid inheritance tax on property in the uk.

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

/images/2021/08/10/happy-woman-doing-taxes.jpg)